The wood county auditor is a crucial resource for accurate and reliable property valuation and taxation information. In addition to providing vital data to the public, the auditor ensures fair and equitable tax assessments throughout wood county.

With their expertise and dedication to transparency, the wood county auditor plays a vital role in maintaining the integrity of property tax assessments and promoting confidence in the local tax system. This article explores the importance of the wood county auditor’s role in property valuation and taxation, discussing their responsibilities, the benefits they provide to the community, and the resources available to help taxpayers understand the assessment process.

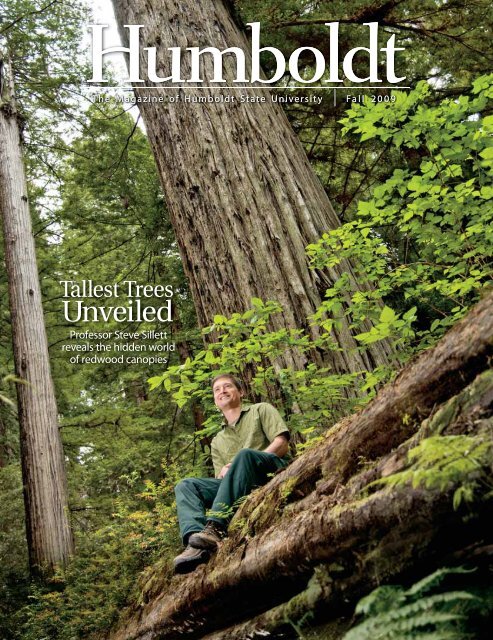

Credit: www.yumpu.com

Understanding The Role Of The Wood County Auditor In Property Assessments

Wood county auditor plays a vital role in property assessments, ensuring a fair and accurate valuation of properties within the county. Understanding the role of the wood county auditor is essential for property owners, prospective buyers, and investors who want to have a comprehensive understanding of property assessments and their impact.

In this section, we will explore the importance of the wood county auditor, their key responsibilities, and their collaboration with other local government entities.

Importance Of The Wood County Auditor

The wood county auditor serves as the guardian of property assessments, ensuring that they are conducted in a transparent and unbiased manner. Here are the key points that highlight the significance of the wood county auditor:

- Valuation accuracy: The auditor’s role is crucial in determining the fair market value of properties. Accurate assessments are essential for equitable property taxes and are fundamental for maintaining the integrity of the real estate market.

- Property tax revenue: Property taxes provide the necessary funds for local government operations and services. The wood county auditor plays a vital role in ensuring that property assessments are conducted fairly, which directly impacts the overall tax revenue generated.

- Public trust: The wood county auditor’s office is responsible for building and maintaining public trust in the property assessment process. By ensuring transparency and objectivity, the auditors contribute to a system that property owners and the public can rely on.

Key Responsibilities Of The Wood County Auditor

The wood county auditor is responsible for various important tasks related to property assessments. Here are the key responsibilities they undertake:

- Property appraisal: The auditor’s office conducts property appraisals to determine the market value of each property in the county. This involves gathering data on property characteristics, conducting market research, and applying appraisal methodologies to arrive at accurate valuations.

- Assessment maintenance: The auditor’s office regularly updates property assessments to reflect changes in property values, construction, renovations, and demolitions. This ensures that property values remain current and reflective of market conditions.

- Appeals process: The wood county auditor provides an avenue for property owners to appeal their assessments if they believe they are inaccurate or unfair. The auditor reviews appeals and makes appropriate adjustments based on evidence presented.

Collaboration With Other Local Government Entities

The wood county auditor works closely with other local government entities to ensure the accuracy and fairness of property assessments. Here’s how they collaborate:

- County assessor’s office: The auditor’s office collaborates with the county assessor’s office to gather property data and ensure consistent assessment practices across the county.

- Board of revision: The auditor’s office works with the board of revision to review and decide on property assessment appeals. This collaborative effort ensures a fair and impartial resolution of disputes.

- Taxing authorities: The auditor communicates assessment information to taxing authorities, such as school boards and municipalities, to assist in determining property tax rates and revenue projections.

By maintaining effective collaborations with these entities, the wood county auditor strengthens the overall property assessment process and ensures a fair and accurate taxation system.

Understanding the role of the wood county auditor is vital for property owners and the community at large. Their responsibilities in property assessments and collaborations with other local government entities contribute to fair taxation, transparency, and public trust in the system.

Unveiling The Secrets: Factors Affecting Property Assessments

Wood County Auditor: Unveiling The Secrets: Factors Affecting Property Assessments

When it comes to property assessments, there are several key factors that can significantly impact the value of a property. As a homeowner or potential buyer, understanding these factors is crucial for making informed decisions. We will delve into the secrets behind property assessments in wood county and shed light on the factors that influence them.

The Impact Of Market Trends On Property Assessments

- Market trends play a vital role in determining property assessments. Here’s how they can affect the value of your property:

- Increasing demand: If the market is experiencing high demand, property values tend to rise, and this can positively impact your property assessment.

- Decreasing demand: On the other hand, if the market is going through a slowdown or recession, property values may decline, leading to a decrease in property assessments.

- Regional variations: It’s important to note that market trends can vary from one neighborhood to another. Understanding the unique dynamics of the market in your specific area can help you gain insights into how assessments may be affected.

How Property Condition And Improvements Affect Assessments

- The condition of your property can significantly influence its assessment value. Here’s what you need to know:

- Maintenance and upkeep: Regular maintenance and repairs can enhance the value of your property and, consequently, its assessment. Ensuring that your property is in good condition can help you attain a favorable assessment.

- Improvements and renovations: Making upgrades or renovations to your property can have a positive impact on its assessment value. Whether it’s adding a new bathroom, upgrading the kitchen, or enhancing the landscaping, these improvements can increase the overall worth of your property.

The Role Of Neighboring Properties In Assessments

- Believe it or not, the value of neighboring properties can affect your property assessment. Consider these factors:

- Comparable sales: Assessors often look at recent sales of similar properties in your neighborhood to determine the value of your property. If neighboring properties have sold at higher prices, it’s likely that your assessment will be influenced accordingly.

- Property characteristics: Proximity to desirable amenities, such as schools, parks, or shopping centers, can positively impact property assessments. Conversely, if neighboring properties have negative characteristics like significant traffic or noise, it may influence your assessment negatively.

Understanding the factors that affect property assessments is essential for all property owners. By being aware of market trends, maintaining your property’s condition, and considering neighboring property values, you can have a clearer understanding of how assessments are determined. Stay tuned for our upcoming articles, where we will explore more intriguing aspects of property assessments.

The Assessment Process: From Evaluation To Final Calculation

Wood county auditor: the assessment process: from evaluation to final calculation

Purchasing a property is a significant milestone in anyone’s life. But have you ever wondered how the value of your property is assessed? In wood county, the assessment process is carefully executed by the wood county auditor’s office. In this blog post, we will dive into the assessment process step-by-step, explore the role of appraisals and inspections, and understand the methods used to calculate property values.

Step-By-Step Breakdown Of The Assessment Process:

Here’s a breakdown of the assessment process that the wood county auditor’s office follows:

- Information gathering: The assessment process starts with the collection of property data, including ownership details, characteristics, and any recent changes.

- Inspections and appraisals: Trained professionals conduct inspections and appraisals to evaluate the physical condition and value of the property. These assessments help determine the fair market value of the property.

- Market analysis: The auditor’s office compares the assessed property to similar properties in the area to establish its market value. This analysis takes into account factors such as location, size, and condition.

- Reviewing and adjusting values: The auditor reviews the assessment values and makes adjustments if necessary. This ensures accuracy and fairness in the assessment process.

- Final calculation: After reviewing all the information gathered and making necessary adjustments, the auditor calculates the final assessed value of the property.

The Role Of Appraisals And Inspections In Property Assessments:

Appraisals and inspections play a crucial role in property assessments. Here’s why they are vital:

- Determining property value: Appraisals and inspections provide valuable insights into the physical condition and characteristics of a property. These factors directly influence the property’s value and help ensure fairness in assessments.

- Ensuring accuracy: Through detailed inspections and appraisals, professionals can identify any aspects that may affect the property’s value. This meticulous process ensures that assessments accurately reflect the current market value.

- Providing evidence: Appraisals and inspections provide evidence for the assessment process. They offer a comprehensive and objective perspective on the condition and worth of the property, establishing a sound basis for assessment calculations.

Understanding The Methods Used To Calculate Property Values:

The wood county auditor’s office utilizes various methods to calculate property values. These methods include:

- Sales comparison approach: This method involves comparing the property being assessed to similar properties that have recently sold in the area. By analyzing these sales, the auditor can estimate the value of the property based on comparable market prices.

- Cost approach: The cost approach determines the property’s value by estimating the cost of rebuilding or replacing the property at current market prices. This method takes into account factors such as land value, depreciation, and construction costs.

- Income approach: Primarily used for rental properties, the income approach considers the property’s income potential. By analyzing rental income and expenses, the auditor can estimate the value of the property based on its income-generating capabilities.

Understanding the assessment process, the role of appraisals and inspections, and the methods used to calculate property values sheds light on how property assessments are conducted by the wood county auditor’s office. This comprehensive process ensures fair and accurate assessments, providing property owners with the confidence that their properties are being evaluated diligently and transparently.

Ensuring Fair Assessments: The Role Of Property Assessment Appeals

Wood county auditor is an essential role in ensuring fair property assessments. One important aspect of this role is handling property assessment appeals. If you’re a property owner dissatisfied with your assessment, understanding the appeals process is crucial. In this section, we will explore how property owners can appeal their assessments, the steps involved in the appeals process, and strategies for a successful appeal.

How Property Owners Can Appeal Their Assessments:

- Start by reviewing your property assessment to identify any discrepancies or errors.

- Gather relevant evidence such as recent appraisals, market data, or comparable properties to support your case.

- Contact the wood county auditor’s office to inquire about the specific guidelines and deadline for filing an appeal.

- Submit a formal appeal following the given instructions, including all necessary documentation.

- Be prepared to present your case at a hearing, where you can provide additional evidence and argue for a fair assessment.

Understanding The Appeals Process:

- Once your appeal is submitted, it will be reviewed by the wood county auditor’s office.

- If your appeal is accepted, a hearing will be scheduled to evaluate the evidence presented.

- During the hearing, you will have the opportunity to present your case and address any concerns or questions from the auditor.

- After the hearing, a decision will be made regarding your assessment.

- You will be notified of the outcome, and if the appeal is successful, the necessary adjustments will be made to your property assessment.

Strategies For A Successful Property Assessment Appeal:

- Thoroughly research and understand the local property assessment laws and regulations.

- Gather strong evidence, such as recent sales data, comparable properties, or professional appraisals, to support your claim.

- Prepare a well-organized and persuasive case, highlighting any discrepancies or errors in your assessment.

- Clearly articulate your arguments during the hearing, focusing on relevant facts and figures.

- Consider seeking assistance from a professional, such as a real estate attorney or appraiser, to strengthen your appeal.

- Maintain open communication with the wood county auditor’s office and provide any additional documentation or information they may request.

Navigating the process of appealing a property assessment can be daunting, but by understanding your rights, following the necessary steps, and presenting a compelling case, you can increase your chances of achieving a fair assessment. Remember, it’s important to be proactive and prepared when disputing your property assessment.

The Impact Of Property Assessments On Property Taxes

Wood county auditor: the impact of property assessments on property taxes

How property assessments influence property tax calculations:

- Property assessments are an important factor in determining property taxes. They serve as the basis for calculating the tax liability of a property owner.

- Assessments are done by the county auditor’s office and involve determining the value of a property based on certain factors such as location, size, condition, and improvements.

- The assessed value is then used to calculate the property tax, which is typically a percentage of the assessed value.

- An increase in the assessed value of a property will lead to an increase in property taxes, while a decrease in assessed value may result in lower taxes.

Understanding the relationship between assessments and tax rates:

- Property tax rates are set by local taxing authorities, such as school districts, cities, and county governments. These rates are applied to the assessed value of a property to determine the amount of tax owed.

- If the tax rate remains the same but the assessed value increases, property owners will see an increase in their tax bill.

- Conversely, if the assessed value decreases while the tax rate remains the same, property owners may experience a reduction in their property tax liability.

Exploring the options for property tax relief or exemptions:

- Property owners may qualify for various tax relief options or exemptions that can help reduce their property tax burden.

- These options include homestead exemptions for primary residences, which provide a certain amount of property value that is exempt from taxation.

- Other exemptions may be available for veterans, senior citizens, individuals with disabilities, or properties used for agricultural purposes.

- It’s important for property owners to explore these options and apply for any exemptions they may be eligible for to potentially lower their property taxes.

Property assessments have a direct impact on property taxes. Understanding how assessments influence tax calculations, the relationship between assessments and tax rates, and exploring available tax relief options can help property owners navigate the complexities of property tax obligations. By staying informed and taking advantage of any applicable exemptions, property owners can potentially reduce their tax liability and ensure a fair and accurate assessment of their property’s value.

Keeping Up With Changes: Staying Informed About Property Assessments In Wood County

When it comes to property assessments in wood county, it’s crucial to stay informed about the latest updates and changes. By understanding the regulations and accessing the right resources, homeowners can ensure that their property assessments are accurate and fair.

In this section, we will explore the resources available for accessing property assessment information, highlight key updates and changes in property assessment regulations, and provide tips on how to stay informed about such changes.

Resources For Accessing Property Assessment Information:

- Wood county auditor’s website: The wood county auditor’s official website is a valuable source for property assessment information. It provides access to online databases where homeowners can find their property’s assessed value, tax records, and other relevant information.

- Online property search tools: Several online platforms offer property search tools that allow homeowners to look up their property assessment details by entering their address. These tools provide quick and convenient access to property assessment information.

- Local tax assessors: Homeowners can also visit their local tax assessor’s office to obtain property assessment information. The tax assessor’s office can provide guidance on how assessments are conducted and assist homeowners in understanding their assessment reports.

Key Updates And Changes In Property Assessment Regulations:

- Assessment methodology: Property assessment regulations may undergo changes in the methodology used to evaluate property values. It’s important to stay informed about any updates in assessment methods to understand how they might impact property values.

- Exemption eligibility: Property assessment regulations can include updates regarding exemption eligibility criteria. Changes in exemption qualifications could affect certain property owners’ tax obligations, making it essential to stay informed about any alterations in exemption eligibility.

- Assessment schedule: Keeping track of the assessment schedule is crucial, as it determines when properties will be reviewed and reassessed. Any changes in the assessment schedule should be noted to ensure homeowners are aware of when their property will be evaluated.

How To Stay Informed About Changes In Property Assessments:

- Subscribe to wood county auditor’s updates: Stay connected with the wood county auditor’s office by subscribing to their email updates or newsletter. This allows homeowners to receive timely notifications about any changes in property assessment regulations or procedures.

- Attend public forums and workshops: Wood county may conduct public forums or workshops to educate homeowners on property assessment-related topics. Attending these events provides an opportunity to learn about changes directly from experts and have any questions or concerns addressed.

- Consult with professionals: Seeking advice from real estate professionals or tax consultants can help homeowners stay informed about property assessment changes. These experts can provide insights into the latest regulations and assist in understanding the implications for property values and tax obligations.

By utilizing the resources available, staying updated on key changes, and actively seeking information, homeowners can ensure they are informed about property assessments in wood county. Being proactive in staying informed will not only help homeowners understand the market value of their properties but also enable them to address any discrepancies or concerns regarding their assessments promptly.

Frequently Asked Questions On Wood County Auditor

What Is The Role Of A Wood County Auditor?

The wood county auditor is responsible for conducting audits to ensure accuracy and compliance with financial regulations. They evaluate financial records, verify tax assessments, and provide transparency in government spending.

How Can I Contact The Wood County Auditor’S Office?

You can contact the wood county auditor’s office by phone at (555) 123-4567 or by email at auditor@woodcounty. gov. The office is open monday to friday, 9:00 am to 5:00 pm, and is located at 123 main street, wood county.

How Can I Access Property Tax Information From The Wood County Auditor?

To access property tax information, visit the wood county auditor’s website and search for the property in question. You will find details such as assessed value, tax payments, and any exemptions applied. This information is updated regularly for public access.

Conclusion

Wood county auditor plays a crucial role in ensuring the financial health and transparency of the county government. With their extensive knowledge and expertise, auditors diligently oversee and evaluate financial records, identify potential risks, and provide recommendations for improvement. By conducting thorough examinations of the county’s financial operations, auditors strengthen accountability and help prevent fraud or mismanagement of public funds.

Additionally, they assist in assessing property values, ensuring equity in taxation, and delivering accurate property tax information to taxpayers. With their commitment to delivering accurate and reliable financial information, wood county auditor supports effective decision-making processes for both the county officials and the public.

Their invaluable contribution serves to enhance trust, integrity, and efficiency in the administration of county affairs. As wood county continues to grow and develop, the auditor’s role remains vital in safeguarding the county’s financial interests while promoting transparency and accountability for the benefit of its residents.